Blog

Quarterly Economic Update First Quarter 2024

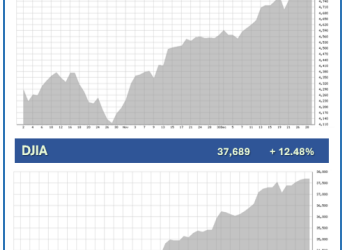

The first quarter of 2024 continued to reward investors who stayed the course and enjoyed strong returns in 2023 as the momentum of 2023’s year-end rally took another step forward. Both equity and bond markets performed well after the Federal Reserve confirmed that...

Proactive Planning: Sunsetting Estate Tax Law

Communication and planning have always been essential when attempting to transfer wealth efficiently. Tax planning can also play a significant role for larger estates. Currently, the federal estate tax laws are very generous, however, when the 2017 Tax Cuts and Jobs...

Special Tax Report

Helpful Information for Filing 2023 Income Taxes and Proactive Tax Planning for 2024 Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to identify as many tax saving opportunities...

Quarterly Economic Update Fourth Quarter 2023

2023 is in the books and the last quarter left investors looking forward to a bright and happy new year. Historically, equities typically have advanced in the fourth quarter, and we can now add 2023 to that statistic. We entered the fourth quarter with strong...

Research

Preferred Securities: Still Our Preferred Non-Core Bond Sector | Weekly Market Commentary | May 13, 2024

It continues to be a challenging environment for a lot of fixed income markets, especially higher quality markets. With the Federal Reserve (Fed) seemingly unlikely to lower interest rates until after the summer months (at the earliest), the “higher for longer” narrative has kept a lid on any sort of bond market rally. And while falling interest rates help provide price appreciation in this higher-for-longer environment, fixed income investors are likely better served by focusing on income opportunities. That’s where preferreds come in. With yields still elevated relative to history, we think preferred securities are an attractive option for income-oriented investors.

Sell in May? Maybe Not | Weekly Market Commentary | May 6, 2024

With the Federal Reserve (Fed) pointing to higher-for-longer monetary policy last week (before Friday’s softer jobs report), we also explore how stocks perform during prolonged Fed pause periods.

Quarterly Economic Update First Quarter 2024

The first quarter of 2024 continued to reward investors who stayed the course and enjoyed strong returns in 2023 as the momentum of 2023’s year-end rally took another step forward. Both equity and bond markets performed well after the Federal Reserve confirmed that...

That Was Quite A Week | Weekly Market Commentary | April 29, 2024

Stocks passed the test, with the S&P 500 up 2.7% for the week, recapturing most of the prior week’s losses despite a mixed GDP report and a double digit decline in shares of social media giant Meta (META) on April 25, after its results. Here we recap the week’s events and check in on sentiment.